7 Tips That Can Help You Increase Your Credit Score.

1. Dispute Errors and Inaccuracies

Recent studies show that as many as 80% of consumer credit files contain

errors and inaccuracies. Chances are you might be 1 of those 80. Errors

and inaccuracies, especially ones that are negatively impacting your

credit scores, can lead to higher interest rates on loans and credit

cards or denials for new credit. After you’ve obtained a copy of your

credit reports review them carefully to identify any items that are

negatively impacting your credit score and highlight everything you

believe to be incorrect, inaccurate, errors or obsolete and using a credit repair software

dispute those items. These could be inaccurate or outdated accounts,

unauthorized inquiries, collection that are not yours, duplicate

derogatory accounts and outdated or unknown public records and accounts

listed as “settled,” “paid derogatory”, “paid charge-off’” or anything

other than “current” or “paid as agreed” if you had in fact paid on time

and in full.

2. Make Payments on Time

One of the most important things you can do to have a high credit score

is to pay your payments on time. Since your payment history alone makes

up the 35% of your credit score making your payments on time is

critical. Late payments that are 30 days or more past due will have a

negative effect on your overall credit score. Late payments stay on your

credit reports for seven (7) years.

3. Make Sure All Your Credit Lines Are Posted On Your Credit Report

Often, some creditors will not post your credit line on your credit

report either by a human error or due to some other mistakes. Showing

less available credit will result in a lower credit score. If you notice

accounts that you have are not showing up on your credit report, you

can request the credit bureau to report these accounts. Also, If there

are past bankruptcies that are closed and should show up with zero

balance make sure to they show a zero balance! In many cases, you need

to file a dispute to request that the creditor reports the “bankruptcy

as a charge off as a zero balance.

4. Pay Down Debt and Don’t Max Out Your Credit Cards.

The second largest factor impacting your credit score is how much you

owe. This accounts for 30% of your score. The more you owe, the lower

your score will be. Someone who owes $30,000 is riskier than someone who

owes only $1000, all else being equal. So a great way to increase your

credit score is to pay down as much debt as you can. Another factor in

the credit score formula is your debt to credit ratio which should not

exceed 60% of your total available credit.

5. Keep Old Positive Accounts Open

Length of credit history is another important credit score factor, so it

can be to your advantage to keep open older accounts that are in good

standing. While it is important to keep the total number of open

accounts manageable, it may be more hurtful to your score to close an

old account than to keep it open even though it increases the number of

open accounts.

6. Keep Revolving Accounts Open

It is very helpful that you maintain a variety of credit accounts. If

you do not have four active credit cards, you might want to open some.

If you have poor credit and are not approved for a typical credit card,

you might want to set up a “secured credit card” account. A secured

credit card requires you to make a deposit that is equal to or more than

your limit. This guarantees the bank that you will repay the loan and

is an excellent way to establish credit.

7. Use Caution When Applying for New Credit.

Every time you apply for a credit card, line of credit, or other loans,

an inquiry is made to your credit report. While new credit is the least

important factor in your score, it is still an important issue to

consider. When you are shopping for a new loan or credit card, do your

shopping in a relatively short period of time. So to avoid these

inquiries, apply for new credit only if you must.

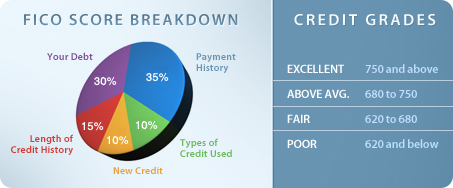

Understand What Affects Your Credit Score

| 330 – 619 | Poor Credit. |

| 620 – 659 | Sub-prime financing will be available to you. |

| 660 – 720 | Prime financing will be available to you. |

| 721 – 750 | Good Credit |

| 751+ | Excellent Credit |

FICO Credit Score Breakdown

The Exact Calculations Of The FICO Credit Score Are Kept Secret As Proprietary Information, But There Are Some General Guidelines That Can Apply

| 35% | of your credit score is based on your timely payment history and takes into account payments that are paid on time in less than 30 days past due. |

| 30% | is based on the credit usage also called a debt to credit ration; i.e., the ratio of current credit debt in comparison to total available revolving credit. Higher debt to credit ratio increases the chances of a payment default. Keeping a low balance on your revolving credit lines results in higher credit score vs having maxed out credit cards. |

| 15% | of your score is determined based on the length of your credit history. |

| 10% | is based on types of credit you have.; i.e., car loans, credit cards, mortgages and personal lines of credit. |

| 10% | is based on inquiries within last six months. When you apply for credit an inquiry is placed on your credit report by the creditor and that affects your credit score negatively. Pulling your own credit has no effect on your credit score – its called a soft pull and doesn’t affect your credit score. |

Categories

Recent Posts

GET MORE INFORMATION

Agent | License ID: 378859